In the rapidly evolving world of cryptocurrency, one of the most crucial tools for managing and safeguarding your digital assets is the crypto wallet. Whether you’re buying, selling, or simply holding onto your cryptocurrency, a secure wallet is vital for protecting your funds from theft, loss, or damage MetaMask extension. This article will delve into what crypto wallets are, how they work, and the different types available.

What is a Crypto Wallet?

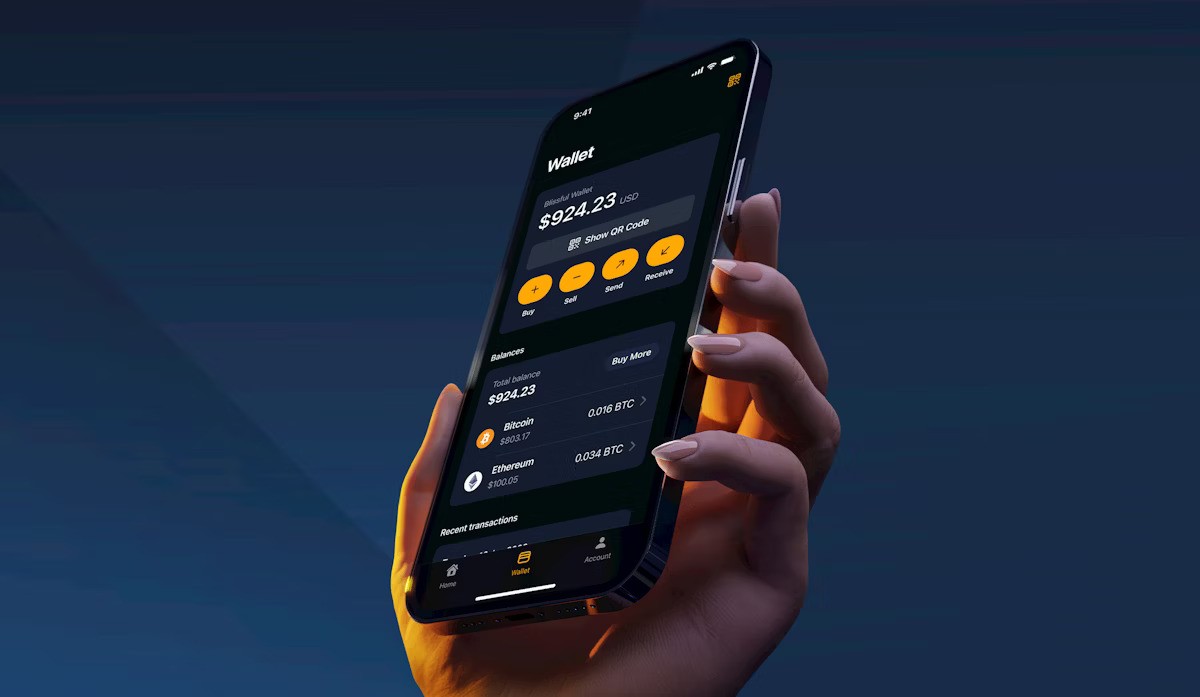

A crypto wallet is a digital tool that allows users to store and manage their cryptocurrency securely. Unlike traditional wallets, which hold physical currency, a crypto wallet stores the cryptographic keys—specifically, private and public keys—required to interact with a blockchain and manage your cryptocurrency. These keys act as a digital signature that proves ownership and enables transactions.

There are two types of crypto wallets:

- Hot Wallets: These are connected to the internet and allow for quick and easy access to your funds, making them ideal for frequent transactions. Examples include web wallets, mobile wallets, and desktop wallets.

- Cold Wallets: These are offline storage solutions, providing a higher level of security by keeping private keys offline. Examples include hardware wallets and paper wallets.

How Do Crypto Wallets Work?

Crypto wallets enable users to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and others. When you create a crypto wallet, it generates a pair of keys:

- Public Key: This is similar to your bank account number. You can share it with others so they can send you cryptocurrency.

- Private Key: This is like a password or PIN and must be kept secret. It allows you to access and control the funds associated with the public key.

When you want to send cryptocurrency, you “sign” a transaction using your private key. The transaction is then verified by the blockchain network, ensuring that you have the authority to transfer the funds.

Types of Crypto Wallets

- Software Wallets

- Mobile Wallets: These are apps that you can install on your smartphone. They’re very user-friendly and perfect for beginners. Examples include Trust Wallet, MetaMask, and Exodus.

- Desktop Wallets: These are applications you install on your computer. They offer greater security than mobile wallets but are more vulnerable to malware. Examples include Electrum and Bitcoin Core.

- Web Wallets: These wallets operate on web browsers, allowing access from any device with an internet connection. However, they are more prone to security risks. Examples include Blockchain.info and Coinbase.

- Hardware Wallets

Hardware wallets are physical devices that store private keys offline. These wallets are considered one of the most secure options for long-term storage of crypto assets. Popular examples include the Ledger Nano S and Trezor Model T. - Paper Wallets

A paper wallet is simply a physical printout of your public and private keys. Since it’s offline, it’s immune to online hacks, but it is vulnerable to physical damage or theft. Paper wallets are typically used for long-term storage. - Brain Wallets

A brain wallet involves memorizing your private key and storing it in your mind, making it one of the most secure methods of storage—provided you don’t forget the key! However, it is extremely risky if you forget or misplace it.

The Importance of Security

While crypto wallets provide a means of storing your assets, they also introduce significant security concerns. Cybercriminals and hackers target wallets with weak security measures, which is why choosing the right type of wallet is essential.

Here are a few tips to keep your crypto safe:

- Use Two-Factor Authentication (2FA): This adds an additional layer of security by requiring a second form of verification (such as a text message or authenticator app) before you can access your wallet.

- Back-Up Your Wallet: Whether you’re using a hot or cold wallet, ensure you have a secure backup of your private keys. A lost private key means lost access to your funds.

- Keep Your Software Updated: Make sure to regularly update your wallet software to ensure you have the latest security patches.

- Avoid Phishing Scams: Always double-check the URL of your wallet provider and avoid clicking on links in unsolicited emails or messages.

Conclusion

Crypto wallets are essential tools in the world of cryptocurrency, offering users a secure and reliable way to manage their digital assets. Whether you prefer the convenience of a hot wallet or the heightened security of a cold wallet, choosing the right solution depends on your needs and risk tolerance. Always prioritize security, back up your wallet, and stay informed about potential risks to protect your investments in the evolving crypto space.